Where to Get Money for Repairs: A Genius Solution You Didn't Know About

Explained in 5 minutes!

Sometimes you urgently need a large sum of money — for apartment repairs or buying a dacha, but you don't have savings. You don't want to miss the opportunity — what to do?

In such cases, banks offer to apply for a loan secured by real estate (Lien on Property). Based on the Lien on Property in Tinkoff, we explain its uniqueness and, most importantly, the benefits.

When can a Lien on Property be useful? Almost in any life situation

First, if you urgently need a large sum of money: buy a house, another apartment, refinance a loan in another bank, or do repairs. By the way, in the last case, you can get back up to 5% of the amount spent on repairs — as cashback (more details in the last point).

Second, a Lien on Property is ideal if you need a small monthly payment. For example, you need 2 million rubles. If you take a regular consumer loan, they will give it to you for three years, but a loan secured by real estate — for ten years. In the first case, the regular monthly payment will be 64 thousand rubles, while in the second — only 23 thousand rubles.

Third, a Lien on Property is taken when banks refuse to give a regular loan or there is no way to prove your income to the bank.

How does it work? Money is provided secured by real estate

Just like a mortgage. The difference from it is that with a mortgage, you can only spend the money on buying property, whereas with a loan secured by real estate (Lien on Property), you can spend the money as you wish: for repairs, buying property, paying workers.

Moreover, a Lien on Property is safer — the bank has very little incentive to take your apartment: they would make less money from selling it than waiting for you to repay the debt.

Also, all documents confirm that you remain the owner of the apartment. The only restriction is that you cannot sell it until the loan is fully repaid. You can continue living in it, register anyone you want, and even rent it out.

What will they give you? A lot, for a long time, and at a low interest rate

You can take a larger sum secured by real estate — from 200 thousand to 15 million rubles for a term of three months to 15 years. A regular consumer loan is less flexible — the sum and term are smaller, around 2 million rubles for 3–5 years. That means they give you less money, and you have to pay a significant amount each month.

However, the monthly payment for a Lien on Property will be small due to its longer term. The longer the loan term, the less you need to pay the bank each month.

The interest rate for a Lien on Property starts from 6.9%. This is much lower than the interest rate for a consumer loan (on average, 12%). It's all due to the collateral — your apartment, which reduces risks for the bank. As a result, they are ready to offer you more favorable and comfortable credit terms.

For example, Tinkoff calculates the rate individually for each client. You will know what it is right after you submit an application.

What documents do you need? Just a passport and SNILS

No income certificate is required, which most banks demand — especially important for freelancers. You can submit an application right now without going to the office.

You will get a response shortly and be informed of the approved loan amount, term, and rate.

Do you need to prepare your apartment for the lien? All the hassle is handled by the bank

- They will come to your apartment at a convenient time with documents for signing, which will become the collateral: this way, the bank verifies that it is real and located at the specified address. You will receive a Tinkoff Black debit card, to which the money will be credited. The card service will be free during the loan term.

- The bank will register and pay for the encumbrance on the apartment in Rosreestr — this is needed to protect the interests of both parties. Usually, it takes two to five working days.

- They can arrange insurance for the apartment on your behalf if you don’t want to do it yourself. According to the law, a client receiving a loan secured by real estate must insure the property. A policy in Tinkoff Insurance costs 0.3% of the loan amount — it can be added to the loan sum.

How to pay? Payments can even be automatic

The bank will calculate the monthly payment amount, and the money will be automatically debited from your debit card. You just need to ensure that there is enough money on the card on the payment day. But this is easy to manage in the banking app.

Want to pay off the loan early? Please do. There are no penalties or fees for this.

You can deposit money to the card in several ways: by bank transfer, from any other bank's card, in cash at Tinkoff ATMs, or at 300,000 bank partners: in communication offices, post offices, money transfer points, and through payment terminals.

Are there bonuses? YES! YOU GET BACK UP TO 20,000 RUBLES

If you make purchases in the “Home and Repair” category using your Tinkoff Black card within a year after the loan is issued, you will receive 5% cashback (but no more than 20,000 rubles in total).

The cashback accumulates with other promotions: if you choose “Home and Repair” again among the six categories offering higher cashback each month, your cashback will reach 10%. You can apply for a Lien on Property in Tinkoff and get back 20,000 rubles for repairs within a year here.

Need a renovation specialist?

Find verified professionals for any repair or construction job. Post your request and get offers from local experts.

You may also like

More articles:

Redesign in 2020. What to Approve if You Need to Redesign an Apartment or Country House

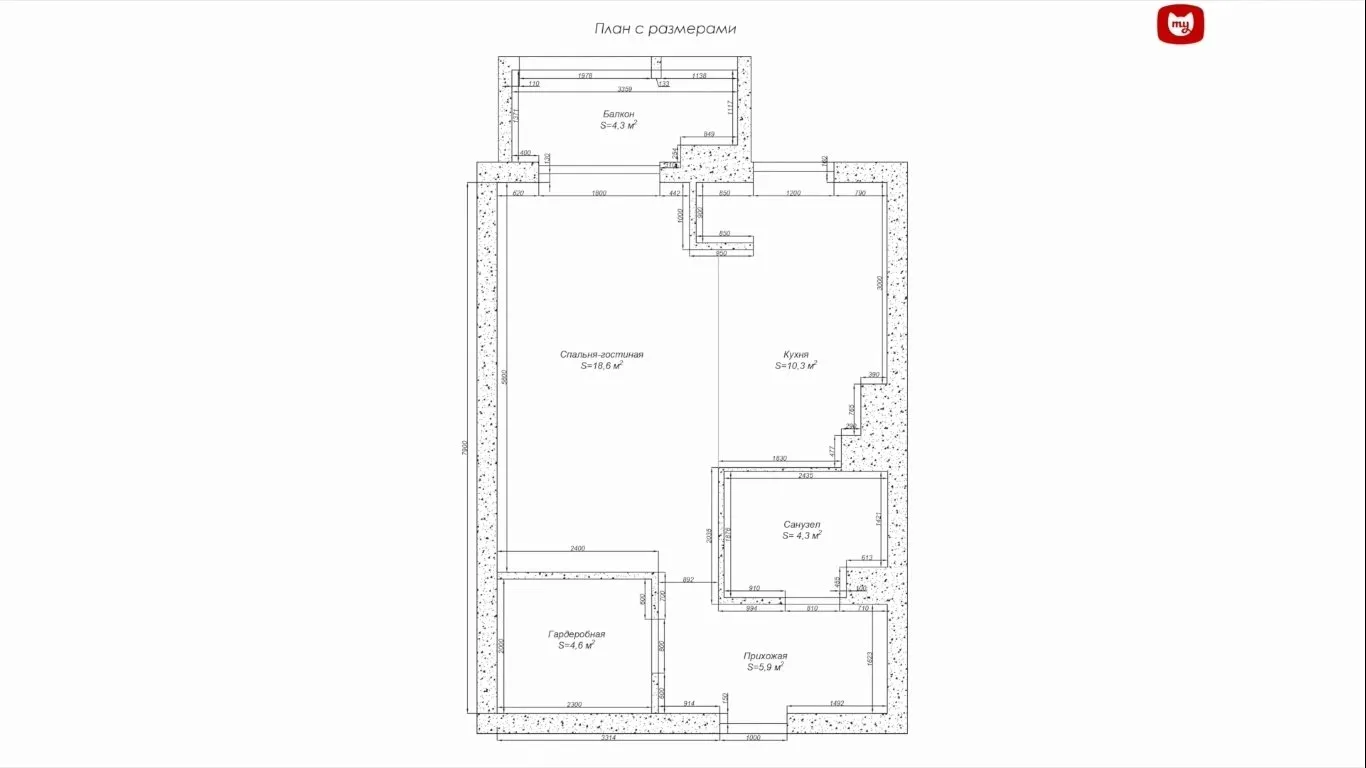

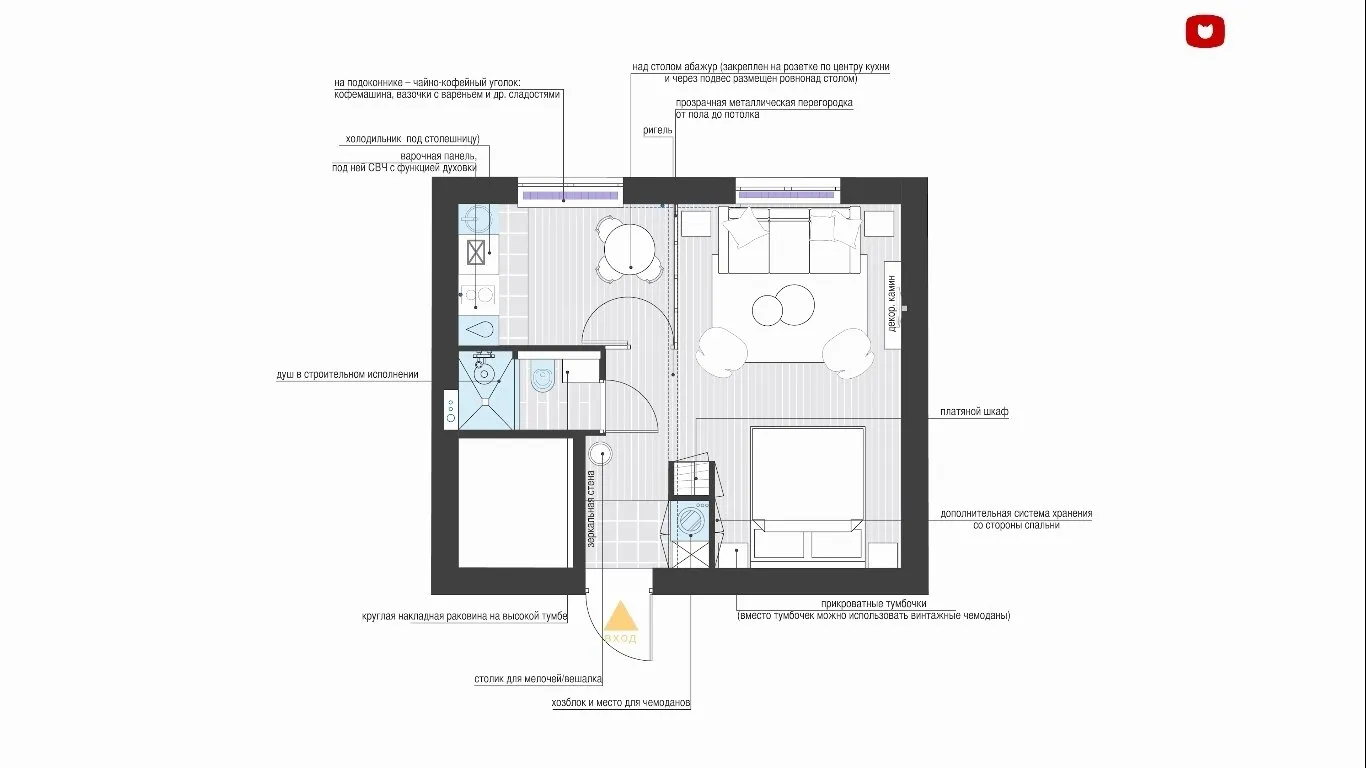

Redesign in 2020. What to Approve if You Need to Redesign an Apartment or Country House Relocation of a One-Room Apartment in a New Building: How It Was Done

Relocation of a One-Room Apartment in a New Building: How It Was Done How to Organize Kitchen Cabinets Once and for All

How to Organize Kitchen Cabinets Once and for All How to Arrange a Kitchen, Bedroom, and Living Room in a 33 m² Apartment?

How to Arrange a Kitchen, Bedroom, and Living Room in a 33 m² Apartment? Brick Walls, Loft Bed, and Balcony Room — Unusual Loft Design by Designer

Brick Walls, Loft Bed, and Balcony Room — Unusual Loft Design by Designer Studio 30 sqm with vibrant finishing and unconventional solutions

Studio 30 sqm with vibrant finishing and unconventional solutions How to Incorporate IKEA Furniture into Designer Interiors?

How to Incorporate IKEA Furniture into Designer Interiors? Kitchens in Corridors: Examples from Projects

Kitchens in Corridors: Examples from Projects