Is It Worth Investing in a Khrushchyovka?

Khrushchyovkas have suddenly become investment targets: as part of the relocation program, purchasing housing that will be demolished can bring profit. However, aside from benefits, there are also risks.

Until recently, apartments in panel five-story buildings were the most undesirable option on the Moscow real estate market. In light of government initiatives, the appeal of khrushchyovkas may increase – now owning an apartment in a five-story building offers prospects for improving living conditions. However, this opportunity comes with both benefits and risks, our expert reminds.

Maria Litinetsкая, Managing Partner at "Metrium Group," a real estate agency and consulting company operating in the Moscow region and St. Petersburg. Benefit 1: Well-developed location

When reviewing housing offers in the Moscow region, buyers quickly realize that within the Moscow ring road, there are few quality housing options in well-developed areas. Therefore, many prefer newer (or relatively new) housing in the suburbs, New Moscow, or districts beyond the MKAD, rather than moving into uncomfortable panel buildings just for a favorable location in Moscow.

According to the redevelopment program for five-story buildings, residents of khrushchyovkas will be relocated either in their area or in a neighboring one, but within the same district. An exception is made for the Central, Zelenograd, Troitsk, and Novomoskovsky administrative districts – their residents can receive new housing in any district. Thus, purchasing a khrushchyovka in a desired Moscow location now may lead to receiving new housing in the same area in the future.

Benefit 2: Investment Capitalization

Benefit 2: Investment CapitalizationIn the explanatory note to the redevelopment bill, deputies emphasize that the cost of new apartments provided compared to those being freed up can increase by up to 35%. In less liquid locations, the price difference between a new construction unit and a khrushchyovka can reach 50%. This means that an apartment in a new building can be resold at a profit, quite quickly, as there are not many new constructions in most Moscow districts.

via GIPHY

Benefit 3: Extra Square MetersAs shown by the previous relocation program for khrushchyovkas, owners received more spacious apartments, despite maintaining a rule of equal area and number of rooms. Usually, new apartments exceeded older ones by 5–10 square meters. Under the current program, additional square meters will be provided free of charge, adding not only convenience but also value to the new housing.

Benefit 4: Full Renovation

Benefit 4: Full RenovationAccording to "Metrium Group," up to 86% of apartments on the primary market in the mass segment are delivered without finishing. This means that costs for buyers don't stop after purchasing an apartment: the cost of renovating a standard studio (up to 45 square meters) ranges from 700,000 to 1.2 million rubles. The condition of properties on the secondary market is often subpar.

Under the current redevelopment program, new buildings for relocated residents will be delivered with full finishing. Moreover, if desired, owners can organize a redesign as noted in the explanatory note to the draft law.

Design: Ruetemple Risk 1: Poor Location

Design: Ruetemple Risk 1: Poor LocationThe main risk at the current stage is the lack of clear relocation rules. It's unknown what alternatives will be offered, in which specific location, and whether one can refuse them. The draft law being considered by the State Duma does not yet provide answers to these questions.

Those living in and purchasing khrushchyovkas in districts where relocation is allowed anywhere (City Center, Troitsk, Novomoskovsky, Zelenograd) are at the highest risk. These residents might lose their housing, for example, in a quiet Vishnevsky Lane (Zamoskvorechye) and relocate to a new building in an area like the Basman district near Elektrozavodskaya metro station. Given the abundance of old industrial sites for construction in this area, new buildings may appear there for displaced residents.

Similar risks arise for owners of non-uniform large districts surrounded by contradictory locations. For example, residents of five-story buildings in Tsaritsyno might be relocated to nearby Cherthano, while inhabitants of Southern Tushino could end up in Mytishchi (beyond the MKAD).

Risk 2: Price Loss

Risk 2: Price LossIn less favorable locations, the cost of alternative new construction might be lower than in secondary khrushchyovkas in more liquid areas. For example, the average cost per square meter in khrushchyovkas in Kuzminki is about 145,000 rubles. In nearby Lyublino, where residents of Kuzminki might be relocated, the average price per square meter in new construction is 132,000 rubles.

However, in most cases, the price difference between old khrushchyovkas and new constructions in neighboring locations is minimal. Simply put, winning from the price difference is not always possible, but losing isn't very likely either. Most likely, most apartments will be no more than 10–15% more expensive than the old ones.

Risk 3: Relocation Timeline

Risk 3: Relocation TimelineThe current program to demolish five-story buildings is much more extensive than the previous one: while in the first wave, about 1,700 khrushchyovkas were demolished, now the authorities plan to get rid of 8,000 buildings and relocate 1.6 million people. Clearly, not all these people will be relocated simultaneously, nor will alternative new buildings for them be built at once. The redevelopment will inevitably proceed in phases, meaning some five-story buildings will be targeted for relocation before others.

Moreover, if the first wave of demolition stretched over 18 years, now the authorities estimate it will take at least 25 years according to the most optimistic projections. This means that some will receive a new apartment within a few years, while others will get one in the span of a decade. Buying a khrushchyovka without a clear understanding of its relocation timeline is extremely unwise. At the same time, it's important to understand that as soon as relocation schedules are known, owners of five-story buildings will immediately raise prices.

Risk 4: Program Withdrawal

Risk 4: Program WithdrawalIt's also important not to overlook general risks related to the country’s economic and political situation. The authorities claim that assistance for private investors is not needed at this time. However, experts from "Metrium Group" note that the program will cost approximately 3.5 trillion rubles based on preliminary estimates, while the annual budget of Moscow is only 1.9 trillion rubles.

Additionally, the economic situation remains difficult. According to the Ministry of Finance’s long-term budget forecast until 2034, government spending as a share of GDP will decrease in the next 18 years due to declining revenues. Therefore, there is a high probability that the redevelopment will not be completed.

If you're planning to purchase an apartment in a building scheduled for demolition with the intention of improving your living conditions, there are many unknowns in this scenario. Furthermore, it is already clear that the conditions for relocation will be much stricter than in the first wave of demolition.

For those who have sufficient funds to purchase a studio in a panel five-story building (from 4.5 million to 7 million rubles), I believe that a more reliable option would be an apartment on the primary market, both in terms of investment and personal residence.

South Park

SOURCE

comedycentral.com

South Park

SOURCE

comedycentral.comOn the cover: Design project for a khrushchyovka apartment.

More articles:

How One Designer Breathes New Life into an Old House

How One Designer Breathes New Life into an Old House 12 Ideas for Equipping a Modern and Comfortable Kitchen

12 Ideas for Equipping a Modern and Comfortable Kitchen 3 Layout Options for a Small Kitchen + Tips from Professionals

3 Layout Options for a Small Kitchen + Tips from Professionals How to Plan a Kitchen: 5 Rules from Professionals

How to Plan a Kitchen: 5 Rules from Professionals How to Quickly Build a Bathroom on a Dacha: 3 Simple Methods

How to Quickly Build a Bathroom on a Dacha: 3 Simple Methods 10 Major Mistakes in Capital Repair

10 Major Mistakes in Capital Repair Only Not Tile: 9 Ideas for Kitchen Backsplash

Only Not Tile: 9 Ideas for Kitchen Backsplash 4 Layout Options for Bathroom in a 'Khrushchyovka'

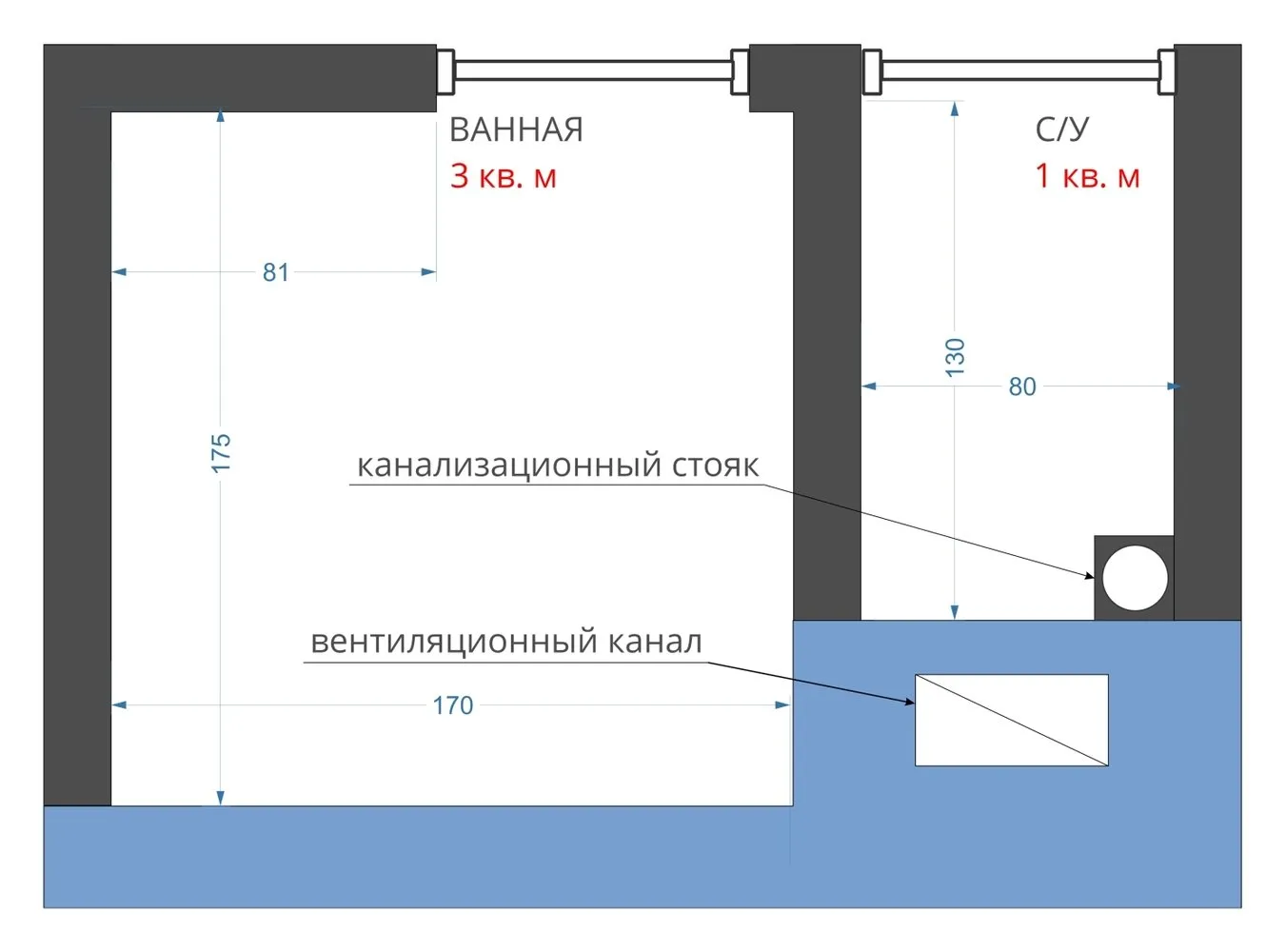

4 Layout Options for Bathroom in a 'Khrushchyovka'