How to Pay Off Mortgage Early and Save Money: Tips + Calculations

It doesn't matter whether you're buying an apartment or taking out a loan for a car. Find out at the bank if you can shorten the payment amount or term. We asked two experts, Olga Konzelievskaya and Inna Semko, which option is more beneficial and how it works. The post includes calculations, and at the end there are tips for everyone preparing to apply for a mortgage.

Inna Semko is an expert in the field of mortgages. She shares useful tips on her Instagram @banki_naiznanky

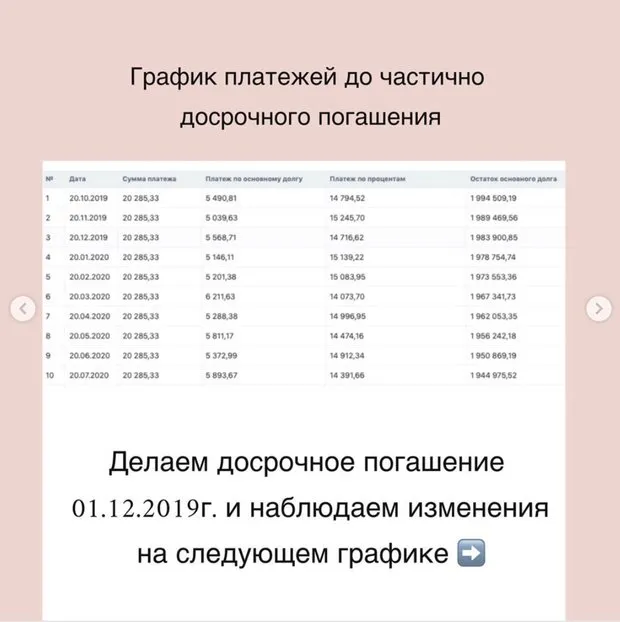

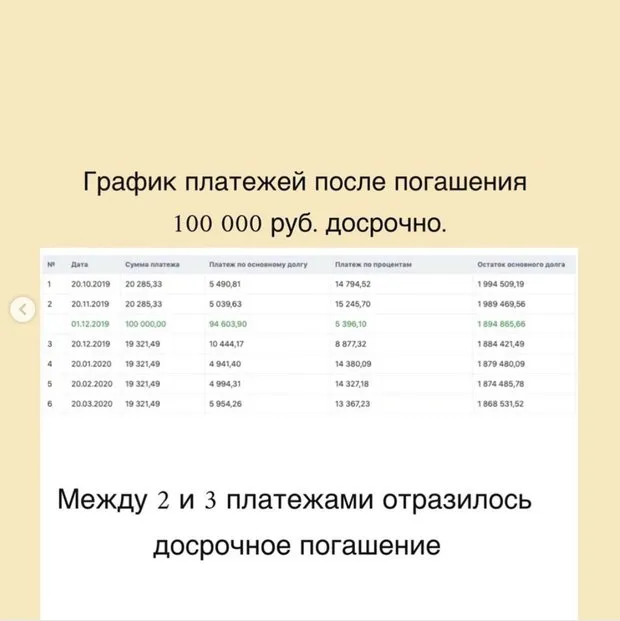

With partial early repayment, two situations can arise:

- You make early repayment on the payment date. Then you pay the monthly payment amount according to the schedule + the amount for early repayment. Everything is clear here: the entire sum goes toward early repayment, and the payment in the next month decreases.

- You make early repayment on any other day. Then part of the sum goes to interest, and the rest goes toward the principal debt.

Why do you pay a larger amount, but it's still deducted as interest?

Why do you pay a larger amount, but it's still deducted as interest?Let's say you make repayment 11 days after your last payment. In that case, the bank calculates interest for these 11 days and deducts it from your sum. The payment amount in the next month will decrease.

Example: the payment of 20,285.33 rubles consists of the principal debt amount (5,568.71 rubles) and interest (14,716.62 rubles). The payment date is the 20th of each month. We'll use the November payment as a basis.

Calculate the interest for using the loan in this month: 14,716.62 (interest) divided by 30 (number of days in the month) = 490.55 rubles.

To find out how much is deducted for 11 days, multiply this sum by 11. You get 5,396 rubles.

In the next month, the payment will be 19,321.49 rubles. Look at the chart below and pay attention to how the principal debt and interest are distributed: after deducting 5,396 rubles that you paid in this month.

Olga Konzelievskaya is an expert in mortgage-related issues with over 12 years of experience. She shares useful tips on her Instagram @ipotekapro

Of course, early repayment is always beneficial: it reduces the principal debt and the total overpayment. There's also a small hack: even if your bank doesn't provide for reducing the term (only reducing the payment), it's not that scary.

Example: your standard monthly payment is 30,000 rubles. You want to make an early repayment and pay 100,000 rubles. Your monthly payment is reduced by 1,000 rubles — that is, now you have to pay 29,000 rubles.

If you continue to pay 30,000 rubles instead of 29,000 and write a statement for partial early repayment for the difference (this must be done to ensure that the payment is deducted from the principal debt — through your personal account or at the bank office), you will get the same result as if the term were shortened.

What's better: reducing the payment or the term?

What's better: reducing the payment or the term?When choosing a bank, always pay attention to whether you can shorten the loan term — it's much more beneficial. To make it clearer, here is an example with numbers.

Example:

- loan amount — 2 million rubles;

- term — 15 years (in many banks it's 182 months, not 180);

- interest rate — 12%;

- monthly payment — 23,910 rubles;

- overpayment on interest — 2,351,140 rubles (if no early repayments are made).

After six months of using the loan, you have 500,000 rubles. You decide to reduce the monthly payment amount.

Pay the entire sum on the seventh month of loan repayment on the payment date and give the bank 523,910 rubles (500,000 — early repayment and 23,910 rubles — monthly payment). The next month, this payment will be reduced to 17,705 rubles. If you don't make any more early repayments, the overpayment on interest over 15 years will be 1,802,713 rubles.

The difference in interest overpayment — 548,427 rubles. That's your savings from the one-time payment of 500,000 rubles.

What if you decide to shorten the loan term instead? You also pay 523,910 rubles on the seventh month of loan repayment on the payment date. The next month, your payment remains the same: 23,910 rubles. However, the loan term is shortened from 182 months to 107! And on the 107th month, the payment is only 7,010 rubles.

This means that instead of 15 years, you will close the loan in just 8 years and 9 months. And the overpayment on interest will be 1,041,470 rubles if you don't make any more early repayments.

Then the difference in interest overpayment will be 1,309,670 rubles!

+ Tips for everyone planning to apply for a mortgage

+ Tips for everyone planning to apply for a mortgageMake sure your credit history is in order — all of it. You can check this for free on any credit bureau website. Four main trusted resources are: NBKI, BKI, OKB, and "Russian Standard".

You can check your debts on the website http://fssprus.ru/ — current arrears over 10,000 rubles may become a reason for credit refusal.

Need a renovation specialist?

Find verified professionals for any repair or construction job. Post your request and get offers from local experts.

You may also like

More articles:

How to Fit Everything in a Small Hallway: 5 Ideas

How to Fit Everything in a Small Hallway: 5 Ideas How to Choose the Perfect Kitchen Sink: 8 Tips

How to Choose the Perfect Kitchen Sink: 8 Tips 2-Room Apartment in Sweden with Brick Wall in Loft Style

2-Room Apartment in Sweden with Brick Wall in Loft Style How to Make a Shelf from Boards and Pipes

How to Make a Shelf from Boards and Pipes Personal Experience: How They Built a Farm and Now Supply Restaurants with Harvest

Personal Experience: How They Built a Farm and Now Supply Restaurants with Harvest Don't Do This: Common Mistakes in Kitchen Renovation

Don't Do This: Common Mistakes in Kitchen Renovation Repair Analysis: Designer Answers Readers' Questions

Repair Analysis: Designer Answers Readers' Questions How to Prepare Your Apartment for Cold Weather

How to Prepare Your Apartment for Cold Weather