Credit for Renovation: How Banks Deceive and How to Fight Back

Read this before going to the bank and save it for future reference: together with a lawyer, we analyze the most important points when signing a contract.

Yuri Kryukov, legal expert, runs his Instagram blog @vkursedela about the rights of co-owners and apartment owners

How to get a loan without making mistakes?

Get several offers from different banks with suitable interest rates.

Ask managers for the credit agreement text and monthly payment calculation for review.

Review the conditions calmly in the terms and clauses specified in the contract.

Study the list of services under the contract, as the bank may try to impose additional services and charge for them.

Calculate the full cost of the loan according to the interest rate to identify hidden fees.

Pay attention to penalty clauses for late monthly payments.

Write down questions you want to clarify and ask the bank employee. If you receive vague answers, consult a lawyer.

If all the conditions offered by the bank suit you — you can sign the contract.

- Carefully check your details when signing.

Can changes be made to a credit agreement?

Can changes be made to a credit agreement?No, so you must decide immediately whether the bank's conditions are acceptable to you.

What if the interest rate on the loan turned out to be higher than what the manager said over the phone?What you hear on the phone or read in advertising brochures is not always the final condition. All credit terms must be written in the contract.

What services might a bank try to impose?

What services might a bank try to impose?- Life, health, and property insurance;

- Bank account management;

- Issuing a bank card;

- SMS notifications.

Evaluate how relevant the service is to you and how much extra you will pay for it.

Can I refuse life and health insurance?Yes, you can refuse insurance within 14 days from the date of signing the contract. However, this may result in an increase in the interest rate on the loan. All terms will be written in the contract.

Can I refuse property insurance?Yes, if it is not used as collateral for the loan.

If I missed one monthly payment, will my credit history be damaged?

If I missed one monthly payment, will my credit history be damaged?Information on the fulfillment of credit obligations is sent to credit bureaus. Violating payment deadlines can worsen your credit history.

However, this does not mean that you will never be approved for a loan again: each bank evaluates history based on its own criteria. Most often, they reject applicants with regular late payments.

Did I file a lawsuit against the bank for refusing imposed insurance? Will this affect my credit history?Information about court cases with banks does not appear in your credit history.

Need a renovation specialist?

Find verified professionals for any repair or construction job. Post your request and get offers from local experts.

You may also like

More articles:

Ideal Lawn for the Dacha: Instructions + Tips

Ideal Lawn for the Dacha: Instructions + Tips Modern Lake House in Canada

Modern Lake House in Canada How to Pay Less for Utilities and Save in Summer

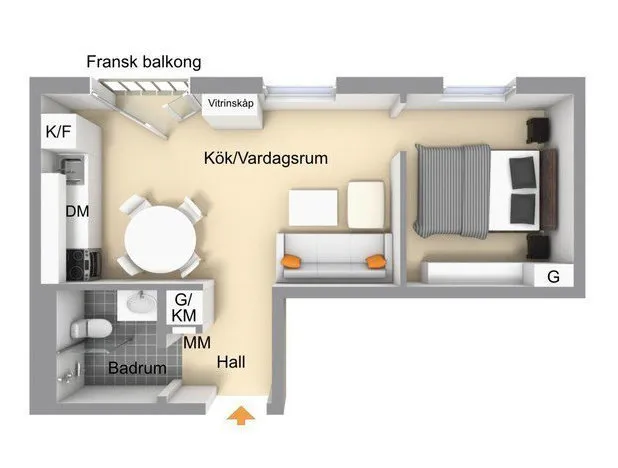

How to Pay Less for Utilities and Save in Summer 5 Ideas for a Mini-Apartment Inspired by Swedish Studio Apartments

5 Ideas for a Mini-Apartment Inspired by Swedish Studio Apartments 6 Common Repair Mistakes That Will Always Be Irritating

6 Common Repair Mistakes That Will Always Be Irritating How Poplar Fluff Is Harmful and How to Deal with It

How Poplar Fluff Is Harmful and How to Deal with It How to Organize Storage in a Small Apartment: 8 Ideas

How to Organize Storage in a Small Apartment: 8 Ideas How We Improved the Layout of a 2-Room Apartment for a Family with a Child

How We Improved the Layout of a 2-Room Apartment for a Family with a Child