5 useful applications to help control expenses

A topic that will always be relevant (and not only during a crisis). Learning to manage your finances wisely

Today, keeping track of expenses is very simple thanks to special mobile applications. We have selected five of the most convenient ones, which are available for iOS and Android.

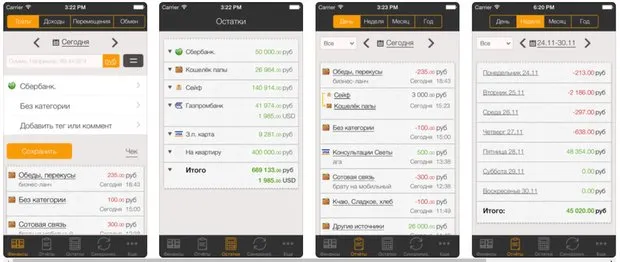

CoinKeeper

What is it? A convenient financial manager with an attractive interface. The main screen is designed like a coin holder, and income, wallets, and expenses are represented as stacks. To record an expense, you need to move a coin from one stack to another.

The app analyzes income and expenses over different periods and helps make forecasts.

What's useful?

- Recording expenses directly at the cash register;

- The ability to set monthly budgets and save;

- Managing a shared budget or using multiple devices through cloud synchronization;

- Balances, expenses, accounts, and balances on one screen;

- Automatic recognition of SMS from banks;

- The ability to save for desired purchases;

- Support for all world currencies;

- High level of data security.

GooglePlay

AppStore

Drebbeden'yi.ru: expense tracking

Drebbeden'yi.ru: expense trackingWhat is it? A minimalist and intuitive manager that simplifies expense tracking and budget planning. To manage personal accounting, just enter data into one of four directories: expenses, income, transfers, and exchanges.

What's useful?- Convenient shopping lists;

- The ability to save for goals and see how much is left until the target amount;

- Tracking debts and debtors, reports on debts;

- The ability to keep accounting in different currencies on different accounts; exchange rates update automatically;

- Photo of receipts and attaching photos to expenses;

- Synchronization with online personal finances and other devices;

- Full analysis and budget planning in the web version. Expense control and accounting;

- Application protection with a password and PIN code;

- Export of data to Excel.

GooglePlay

AppStore

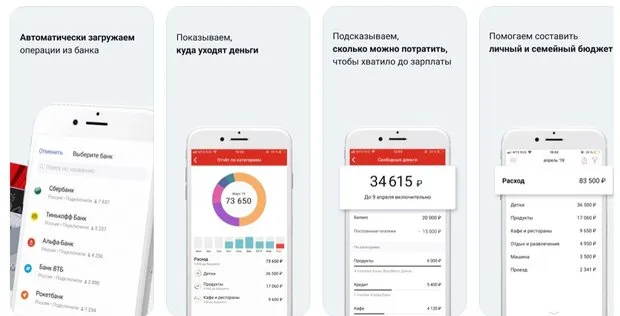

Zen-Money: expense tracking

Zen-Money: expense trackingThe application for personal and corporate accounting. It can automatically record expenses and distribute them by categories, which eliminates the need to enter data manually. Zen-Money synchronizes with Sberbank, VTB, Tinkoff, Raiffeisen, Alfa, Home Credit, Open, Citybank, Rocket Bank, Yandex.Money, QIWI and other banks.

- Synchronization with banks and distribution of expenses by categories;

- Budget creation, expense planning, statistics tracking;

- Always up-to-date balance on all accounts;

- Reminders of where and when to start saving;

- Tracking borrowed money: the app gently reminds friends about returning debts;

- The ability to add electronic receipts via QR code;

- Features for managing a shared budget, synchronization between different devices.

What's useful?

GooglePlay

AppStore

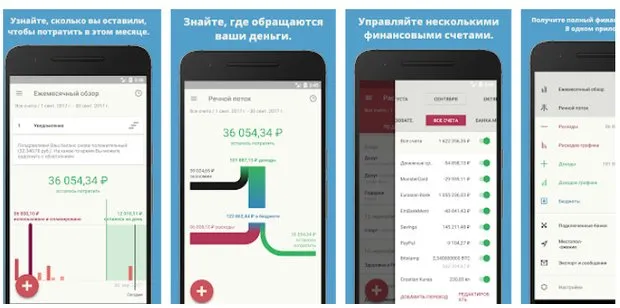

Toshl Finance: expenses, income and budgets

Toshl Finance: expenses, income and budgetsToshl allows you to track all your credit cards, bank accounts, and cash from one application. Graphically it clearly shows the flow of money by months and how much money is available for spending this month. A simple and clear interface is pleasant to look at and makes financial control easy and enjoyable.

- Simple and fast data entry in just four clicks. Hint calculator;

- Automatic connection to more than 14,000 different bank accounts, credit cards or financial services in Russia and around the world;

- Useful charts: general overview of cash flows for each month, amount available for spending according to budget goals, sectoral and pie charts, spending map;

- Notifications when approaching budget limits.

What's useful?

GooglePlay

AppStore

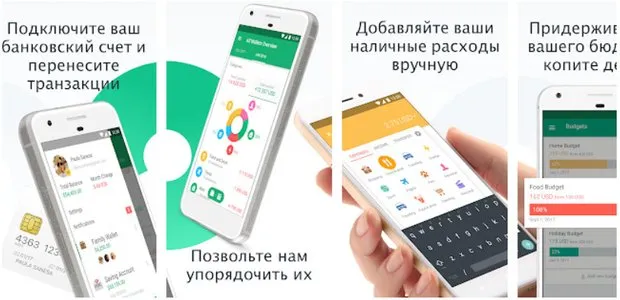

Spendee: creating a budget and tracking expenses

Spendee: creating a budget and tracking expensesMinimalist functionality is an undeniable advantage of Spendee: to add a purchase to the database, it only takes a few seconds. The income statistics section will help you avoid buying unnecessary small items in the future. A pleasant bonus is beautiful infographics of income and expenses.

What's useful?

- The ability to monitor expenses manually or safely connect a bank account;

- Easy and fast addition of expenses;

- The ability to create shared accounts for family and friends;

- Support for multiple currencies simultaneously (perfect for travel);

- Customizable wallets for special occasions: vacations, anniversaries, weddings, car purchases, etc.

GooglePlay

AppStore

Need a renovation specialist?

Find verified professionals for any repair or construction job. Post your request and get offers from local experts.

You may also like

More articles:

How to Design a Comfortable Kitchen-Living Room: 6 Ideas from Our Projects

How to Design a Comfortable Kitchen-Living Room: 6 Ideas from Our Projects Apartment on the attic, which you will definitely want to save to Pinterest

Apartment on the attic, which you will definitely want to save to Pinterest Home Decorated with Nature: Example from the USA

Home Decorated with Nature: Example from the USA Reconfiguration in a Khrushchyovka: How It Was Done?

Reconfiguration in a Khrushchyovka: How It Was Done? Small Kitchen: How to Make It Functional?

Small Kitchen: How to Make It Functional? How to Arrange a Bedroom in a Stalin-era Apartment: 7 Ideas

How to Arrange a Bedroom in a Stalin-era Apartment: 7 Ideas 10 Cool Products That IKEA Reduced Prices On

10 Cool Products That IKEA Reduced Prices On How We Completed a Family Apartment Remodel in 3 Months

How We Completed a Family Apartment Remodel in 3 Months