Credit for Renovation: How Banks Deceive and How to Fight Back

Read this before visiting the bank and save it for future reference: together with a lawyer, we analyze the most important points when signing a contract.

Yuri Kryukov — a legal expert, runs his own blog on Instagram @vkursedela about the rights of co-owners and apartment owners

How to get a loan without making a mistake?

Get several offers from different banks with suitable interest rates.

Ask managers for a copy of the loan agreement and monthly payment calculation for review.

Review the conditions calmly in detail, as specified in the contract.

Check the list of services included in the contract, as the bank may try to impose additional services and charge for them.

Calculate the full cost of the loan according to the interest rate to identify hidden fees.

Pay attention to penalties for late monthly payments.

Write down the questions you want to clarify and ask them to the bank employee. If you get vague answers, consult a lawyer.

If all the conditions offered by the bank suit you — you can sign the contract.

- Check your details carefully when signing.

Can changes be made to a credit agreement?

Can changes be made to a credit agreement?No, so you need to decide immediately whether the bank's terms are acceptable.

What if the interest rate turns out to be higher than what the manager said over the phone?

What you hear on the phone or read in promotional materials is not always final. All credit conditions must be stated in the contract.

What services can the bank force upon you?

What services can the bank force upon you?- Life, health and property insurance;

- Bank account maintenance;

- Issuance of a bank card;

- SMS notifications.

Assess how relevant the service is to you and how much extra you will pay for it.

Can I refuse life and health insurance?

Yes, you can refuse insurance within 14 days from the date of signing the contract. However, this may result in an increased interest rate on the loan. All conditions will be included in the contract.

Can I refuse property insurance?

You can, if it is not used as collateral for the loan.

If I missed one monthly payment, will it damage my credit history?

If I missed one monthly payment, will it damage my credit history?Information about loan repayment is sent to credit bureaus. Violating the payment schedule can worsen your credit history.

However, this does not mean that you will never get another loan: each bank evaluates your history based on its own criteria. Most often, they deny loans to those who had regular late payments.

I sued a bank for refusing to cancel imposed insurance, will this appear in my credit history?

Information about legal disputes with banks does not appear in your credit history.

Need a renovation specialist?

Find verified professionals for any repair or construction job. Post your request and get offers from local experts.

You may also like

More articles:

Ideal Lawn for the Dacha: Instructions + Tips

Ideal Lawn for the Dacha: Instructions + Tips Modern Lake House in Canada

Modern Lake House in Canada How to Pay Less for Utilities and Save Money in Summer

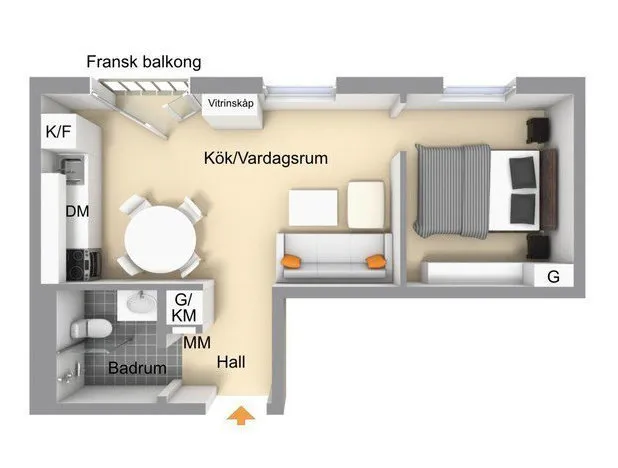

How to Pay Less for Utilities and Save Money in Summer 5 Ideas for a Mini-Apartment Inspired by Swedish Studio Apartments

5 Ideas for a Mini-Apartment Inspired by Swedish Studio Apartments 6 Common Repair Mistakes That Will Always Annoy You

6 Common Repair Mistakes That Will Always Annoy You How Poplar Fluff Is Harmful and How to Deal With It

How Poplar Fluff Is Harmful and How to Deal With It How to Organize Storage in a Small Apartment: 8 Ideas

How to Organize Storage in a Small Apartment: 8 Ideas How We Improved the Layout of a 2-Room Apartment for a Family with a Child

How We Improved the Layout of a 2-Room Apartment for a Family with a Child